It may seem a strange question to ask on a car finance website, but not many people know exactly how car finance works. We find that a large number of our customers have never encountered car finance until they come to Creditplus looking for a way to fund a purchase of their new car. It can be daunting, with lots of terms and details that may seem confusing to those inexperienced with finance. Here at Creditplus, we work hard to ensure that we provide all the information needed for customers to make an informed decision on car finance - its part of our commitment to ethical lending. In this blog, we'll point you towards useful resources as we answer the question: "How does car finance work?"

Car Finance Explained

Car Finance, simply put, is a way of spreading the cost of purchasing a vehicle over a set period of time across affordable monthly payments. This means you can potentially purchase a more expensive car then you would if you had to pay the whole cost up front. Unlike a personal loan, car finance is usually secured against the vehicle. Car finance comes in a number of different products, with various options and requirements for each product that make them suited for different circumstances. The main products are: Personal Contract Purchase, Hire Purchase, and Lease Purchase.

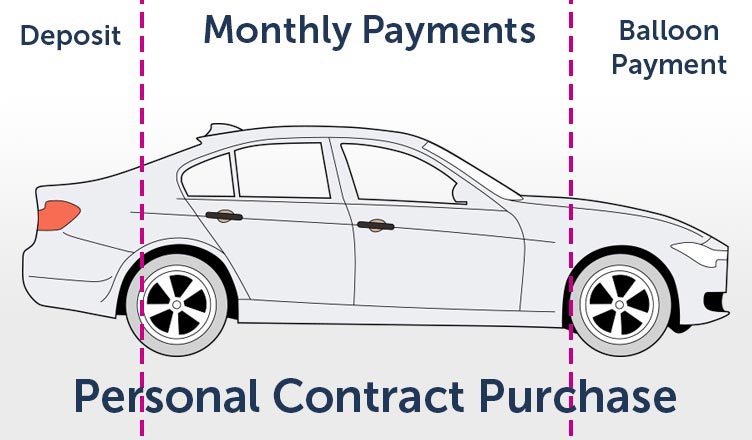

Personal Contract Purchase

Personal contract purchase or PCP is a finance option that gives you three very different options at the end of an agreement. Like most finance packages, you pay monthly payments, however at the end you have three choices: pay a final payment and keep the car, return the car to the dealer, or trade the car in against a new car. PCP works best with a deposit, the bigger the better. When you finance the car, you will be given a guaranteed future value of the car at the end of the agreement. You then effectively pay the depreciation across the monthly payments. At the end of the agreement, you decide on one of the three options.

The final payment (or balloon payment) is the guaranteed future value, and must be paid to keep the car. Because you don't own the car throughout the agreement, most PCP deals come with a yearly mileage limit to preserve the guaranteed future value. PCP is ideal for someone who wants to change their car every 2 or 3 years.

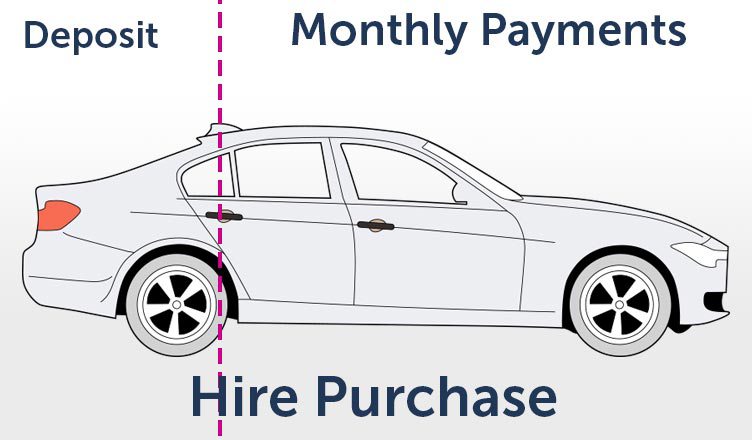

Hire Purchase

Hire Purchase or HP is car finance that spreads the entire cost of the finance package across the agreement. At the start, you will be given a breakdown of the costs, including the fixed rate of interest. The total cost is then divided across the length of your agreement. Hire Purchase agreements require a deposit. We always recommend customers pay a deposit, as it lowers the cost of monthly payments. There is such a thing as zero deposit car finance but it requires a very good or excellent credit score.

The good thing about Hire Purchase is that after a certain period of time set at the start of the agreement, you can pay off the agreement early. This makes Hire Purchase ideal for those looking for a new car who expects their finances to improve in the future. The fixed monthly payments are also a key aspect of hire purchase, allowing you to budget for them going forward, even if your monthly income changes.

Lease Purchase

Lease Purchase or LP is an option that allows you to have some control over the monthly payments. In this option, you can defer some of the cost to the end of the agreement, in effect setting your own balloon payment. You can defer up to 31% to the end of the payment period, reducing the monthly costs. Unlike PCP, you have to pay this balloon payment, however you can refinance this cost. Like Hire Purchase, interest is at a fixed rate and the total cost is spread across the agreement. This control can help you reduce the costs of monthly payments with an eye towards saving for the final balloon payment.

Find out more about Lease Purchase over at our car finance glossary.

How car finance is calculated

When you apply for car finance, your application is assessed based on your credit rating. This assessment is designed to examine how much of a risk it would be to provide you with money. The higher the risk, the less likely a lender will provide finance to you. In most cases, those with a bad or poor credit rating will still be able to get finance but will generally have to pay more to offset the risk the lender is taking. Those with a good or excellent credit rating will get the best terms.

When it comes to choosing which car finance product is right for you, a good customer advisor will explain to you the different products available to you. PCP is generally more available to those with an excellent or good credit rating. Your customer advisor will also be able to look at the car finance options available and present to you the best deal based on your financial circumstances. For example, you might have an option with higher APR but the ability to spread the cost and have lower monthly payments. All FCA compliant companies should provide a transparent process, providing you with all the information you need to make the right decision. If they don't, then you might want to reconsider your application.

Useful links: Car finance calculator

Key Terms Explained

So we've started answering the question "How does car finance work?" But you may have noticed a few terms that are unfamiliar to those who do not know much about finance. We understand that they can be confusing, so we created a car finance glossary which goes over all the key terms. Here are a few excerpts below:

Balloon payment: This is the term used for the amount you have to pay at the end of a PCP or LP agreement to purchase a car. It is normally based on a guaranteed future value (in a PCP agreement) that confirms the value of a vehicle at the end of the finance period.

Credit rating: This is the score given to you by car finance companies based on your financial history. The higher the score, the more evidence you have of making payments on time and clearing your debts. The lower the score, the more difficulties you have had in the past.

Guaranteed future value: This is the value of a car at the end of the finance period. It is calculated by gauging the amount of depreciation a car will suffer across the finance agreement period. It is normally based on a number of factors such as regular servicing and mileage agreements. To preserve this, that may mean limitations to where you can have your car prepared and the amount of miles you can drive each year.

APR: This stands for "annual percentage rate". It tells you how much the finance provider will charge you each year based on the amount of money you borrow. It normally depends on your credit rating. The better the credit score, the lower the APR.

Fixed interest rate: Interest rates change regularly, primarily due to how the country's economy is performing. A fixed interest rate means that this will not change across your agreement, ensuring that your payments remain the same.

FCA: FCA stands for the Financial Conduct Authority. They are responsible for regulating all finance providers in the UK to ensure that consumers are getting a fair deal. They have recently made changes to make customer service a bigger priority, excellent news for consumers.

For more car finance terms explained, visit our car finance glossary.

How does car finance work? - Further reading

Hopefully we've helped explain car finance in this blog post. But if you have more questions, you can visit our comprehensive help and advice section. We go over all the most frequently asked questions in more detail, and regularly update it with feedback from our customers. In the help and advice section, you will also find our LiveChat facility, where you can talk directly to one of our advisors who will be happy to answer your questions or point you in the right direction. Want to speak to a customer advisor over the phone? Call us on 0800 1777 290 and one of our customer advisors will be happy to answer any questions you have.

For unbiased advice on car finance, you can always visit the Money Advice Service for information.

Ready to find the perfect car finance package for you? Then complete our simple and straightforward 2 minute car finance application form. One of our customer advisors will soon be in touch to get you on the road to your new car.

Apply online today.

Facebook

Facebook Twitter

Twitter Instagram

Instagram LinkedIn

LinkedIn Youtube

Youtube